Elevate Your Banking Experience

Heritage offers a concierge experience with a dedicated private banker focused on your banking needs, designed with a personal touch and a commitment to help facilitate and support your specific financial needs and lifestyle as a Private Banking client. Summit Checking is our exclusive checking account designed for Private Banking clients seeking the pinnacle of personalized banking services, offering the luxury of a high-end metal card, higher mobile deposit limits of up to $25,000, daily ATM withdrawals of up to $5,000, and a suite of additional benefits including free debit card replacement, cashier's checks, stop payments, and internal debit card transaction fee refunds while traveling.

Services Offered:

- Personal Loans

- Business Loans

- Personal Checking

- Business Checking

- Account Management

Benefits of Private Banking:

- Concierge services for all your banking needs

- Dedicated expert overseeing your account

- Expedited solutions to your requests

- Local support

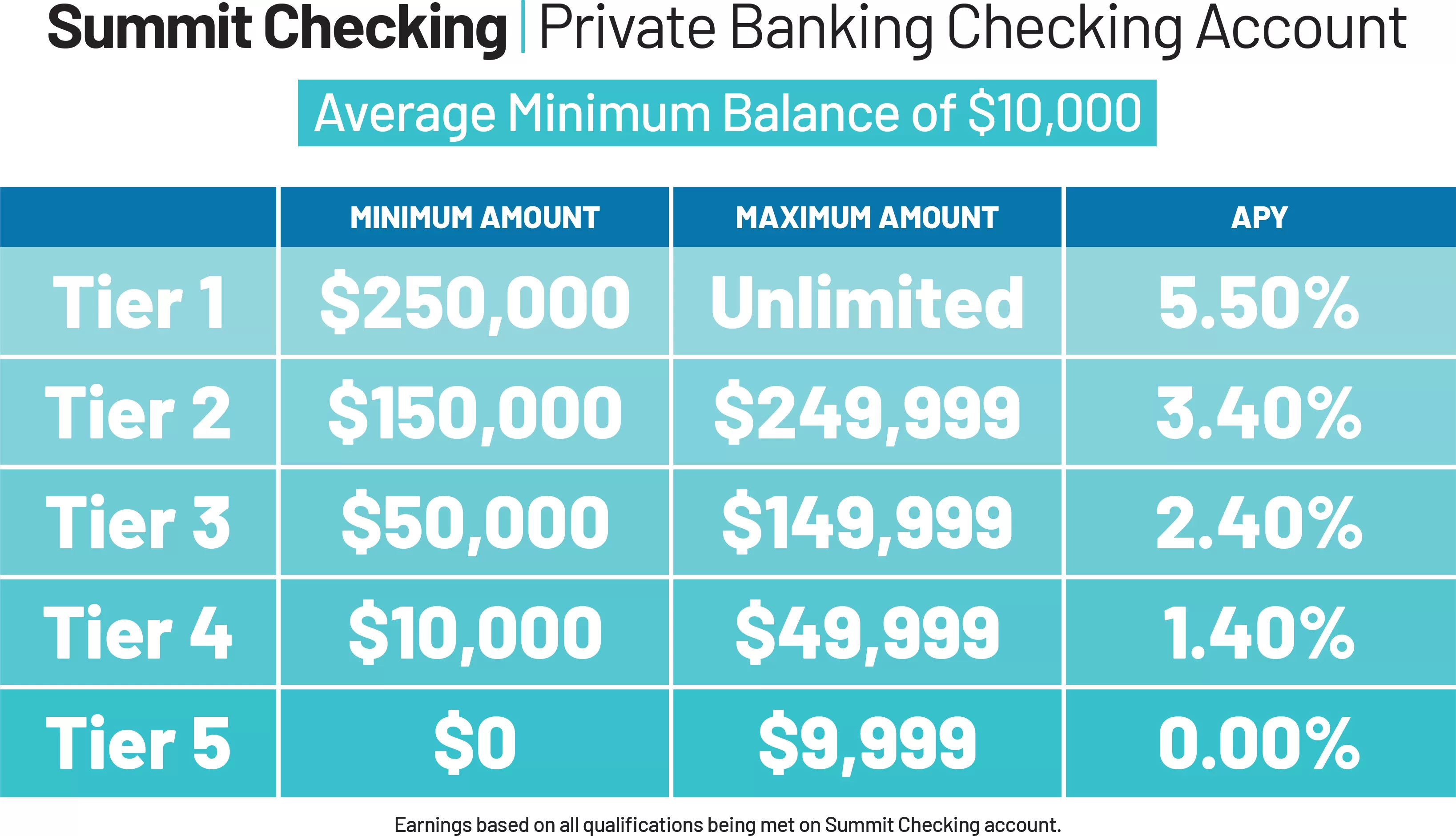

Summit Checking

Benefits

- Higher mobile deposit limits of up to $25,000

- Daily ATM withdrawal of up to $5,0001

- $50.00 max card refund per month2

- Free debit card replacement

- Free cashier's checks

- Free stop payments

- Refund international debit card transaction fees while traveling

- Metal card

- Exclusively for Private Banking clients

Relationship Pricing

- $1,500 reduction in Heritage mortgage closing costs4

- 0.25% additional rate discount on Heritage term loans (also eligible for 0.25% discount for auto pay if applicable)5

Qualifications:

- At least 12 (pin-based/signature-based) debit card purchases

- Be enrolled in and log into Digital Banking and eStatements

Private Referral

Refer a Private Banking client.

1ATM benefits require a qualifying account. To qualify for ATM fee refunds and international debit card transaction refunds up to $50 per month, your account must meet the following requirements: At least 12 (pin-based/signature-based) debit card purchases ,be enrolled in and log into Digital Banking, and enrolled in eStatements. Reimbursements will be credited to your account at the end of each month. Other fees may apply.

2Up to $50 per month refund on ATM fees and international transaction fees

3Subject to credit review. Insurance required.

4Subject to credit approval. $1,500 can only be used on closing costs. Property insurance required. All funds will be verified.

5Eligible loans are fixed rate installment consumer titled vehicle loans. All loans are subject to credit approval. To be eligible for the additional .25% reduced rate, monthly loan payments must be automatically debited from a Heritage checking account. Insurance is required. Some restrictions apply. Rates, terms, and conditions are subject to change without notice.